Algorithmic Trading and Portfolio Management

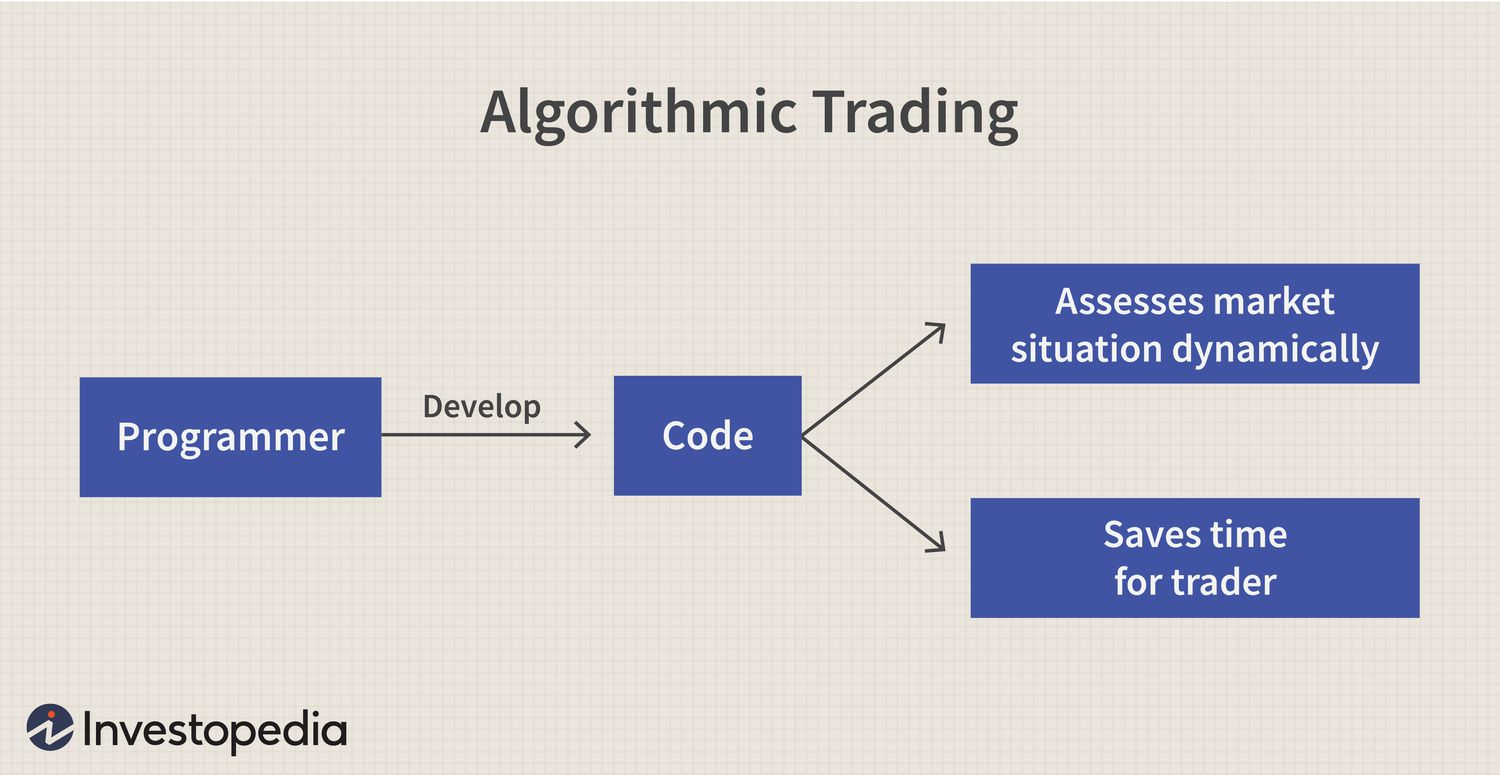

Algorithmic trading at a basic level is using AI to predict and essentially “win” in the market, and has revolutionized financial markets by leveraging AI’s ability to make rapid, data-driven decisions. AI algorithms, at a base level, analyze vast datasets, identify patterns and trends that might be less viable for humans to track, and then make an executive decision. These algorithms execute trades within milliseconds and optimize the returns from investments whilst also minimizing too much potential risk. Take, for example, a machine learning model that can predict market movements based on historical data and new decisions that have just been filed in the government–this model analyzes all this material hundreds of thousands of times faster than humans could realistically be able to, allowing traders to capitalize.

In portfolio management, AI-driven systems offer a more dynamic and cleaner approach to traditional methods. While traditional methods rely on limited data sets and human intuition to forecast the method, sell, buy, etc, AI models can analyze a wider range of data points from market trends to economic indicators to make the same decisions. These systems can dynamically adjust portfolios based on real-time conditions to ensure that investments are always aligned with the investor’s goals and risk tolerance. The efficiency and accuracy of this tool in the financial sector have and will continue to change the industry.

Source: Investopedia