Analyzing Example Portfolios

1 / 4

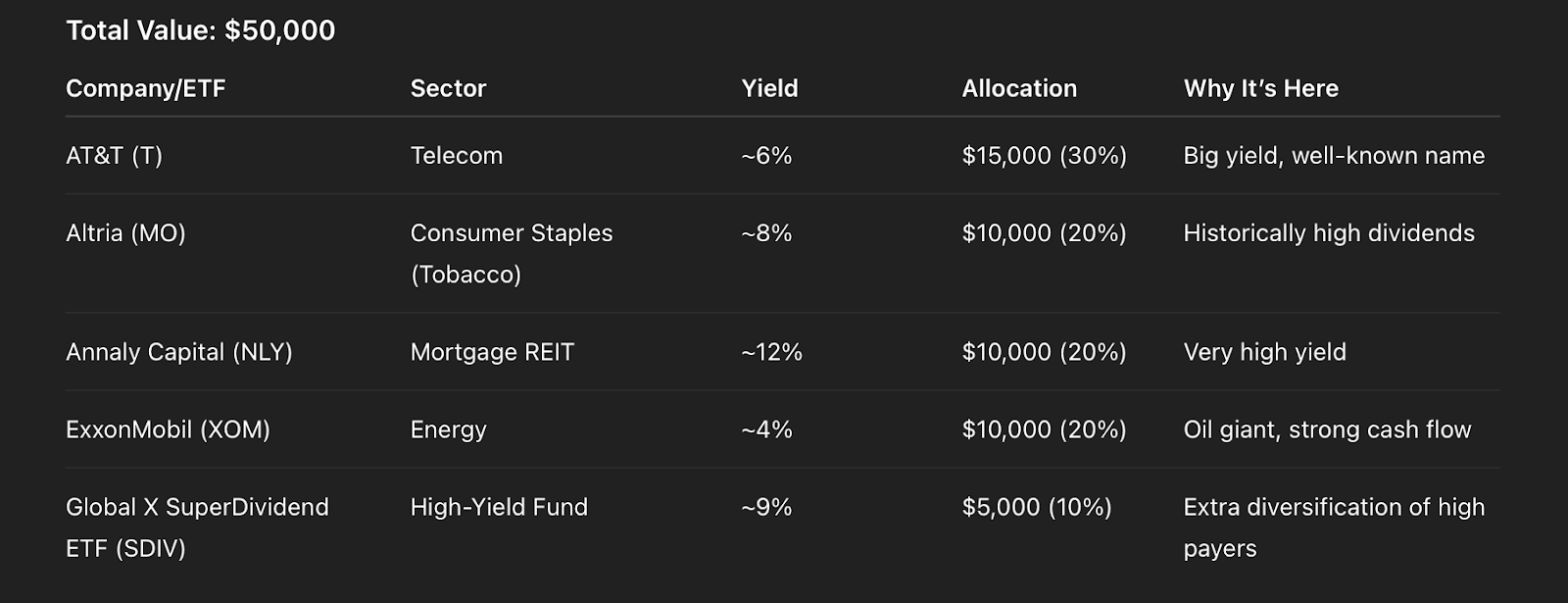

Pros:

- Huge income stream from day one (~7–8% = $3,500–$4,000 a year).

- Attractive for retirees who want cash flow now.

- Familiar companies with a long dividend history.

Cons:

- Dividends can be cut (AT&T cut by 50% in 2022).

- Many holdings are in declining industries (tobacco, oil, REITs).

- Portfolio growth is weak, meaning income may not keep up with inflation.