Payout Ratio, Free Cash Flow, and Dividend Safety

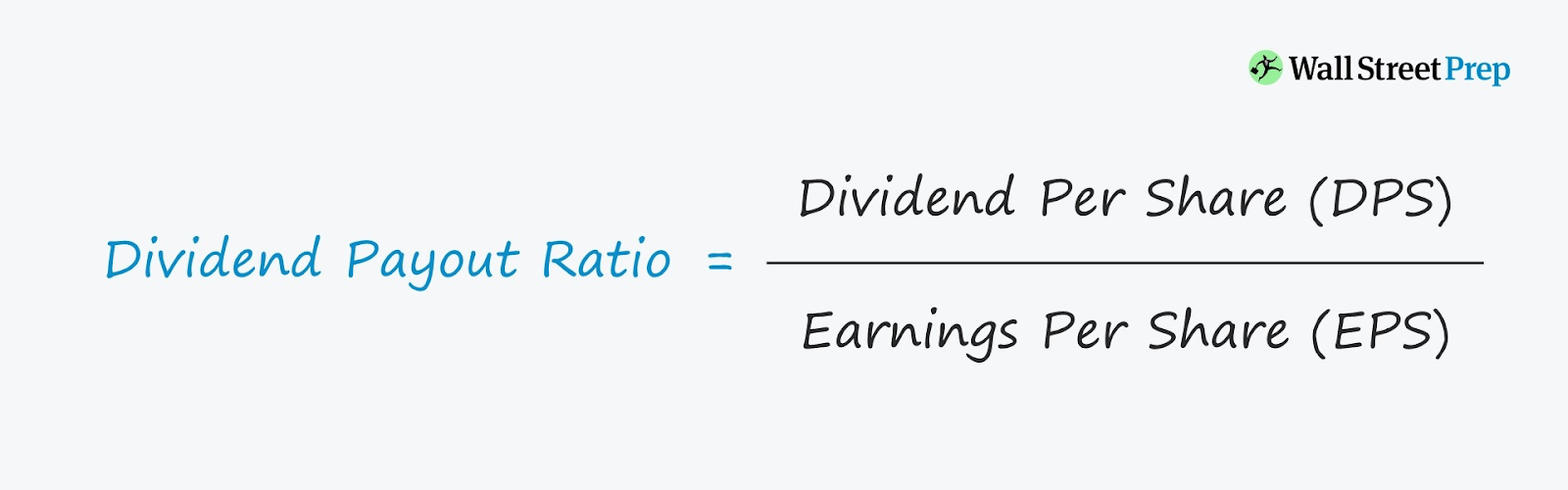

The payout ratio compares a company's earnings to its dividend payments. It is calculated using the following formula:

Source: Wall Street Prep

For example, a company with $100 million in yearly earnings that gives back $30 million in dividends would have a payout ratio of 30%. Note that when calculating payout ratio, it is important to ensure that the earnings and dividend payment used are over the same amount of time.

While it is great for a company to give back significant dividends, a high payout ratio can signal future instability. This is because the company has little money to reinvest in growth and innovation since it is giving so much of its profits. In the case of a market downturn, such a company would find itself at high risk, causing investor stock values and dividends to drop.

A high payout ratio can also be the result of dropping profits. If a company's bottom line drops by 50%, its payout ratio would double. This makes the company a riskier investment, even though its payout ratio has increased.