Smart Investments

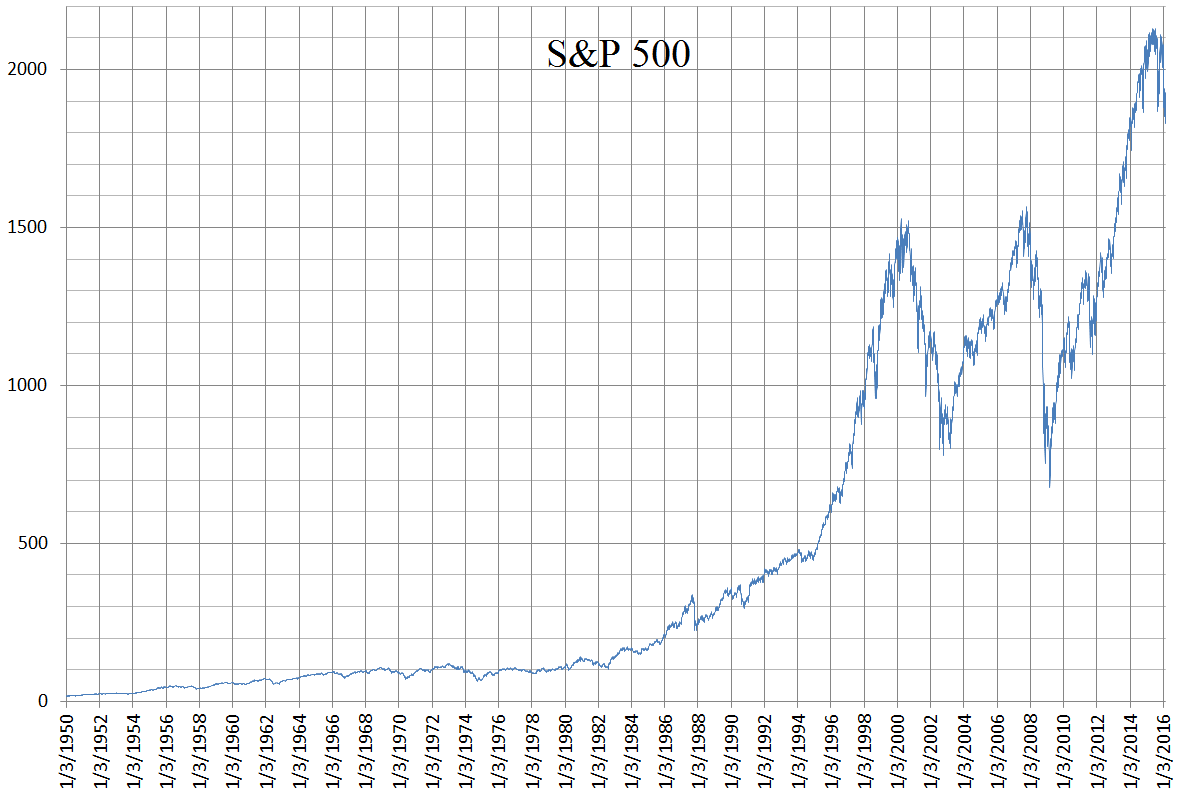

You can make a 20% return on your investment and still have made a poor investment. Likewise, you can lose 20% on an investment and still have made a good investment. Why? Because good investments are measured by whether or not they outperform the market, which is indicated by how indexes like the Dow Jones Industrial Average, S&P 500, and Nasdaq Composite perform during the same time period.

Source: Wikipedia

With that in mind, let’s start with some general principles to keep in mind for investing during a downturn. First, the likelihood that you need to liquidate your asset and turn it into cash to pay an immediate personal need is higher in these periods than during economic booms. But that really depends on your specific situation and time horizon. Real estate investments are a perfect example of this. While the price of a house is unlikely to shoot down as much as that of a stock during a recession, the likelihood that you can sell that house during a recession is much lower. For most people, you’ll want to find a balance between accessible and stable investments during downturns. Second, your mindset shouldn’t necessarily be to maximize gains, but instead to preserve your money during these periods. Otherwise, you may end up taking excessively risky gambles that are unwise. For example, many investors try to time the market, meaning that they figure out where the exact lowest point of the dip is and invest heavily into assets (usually stocks) there. Often, this fails and only results in greater losses.

Source: The Long-Term Investor

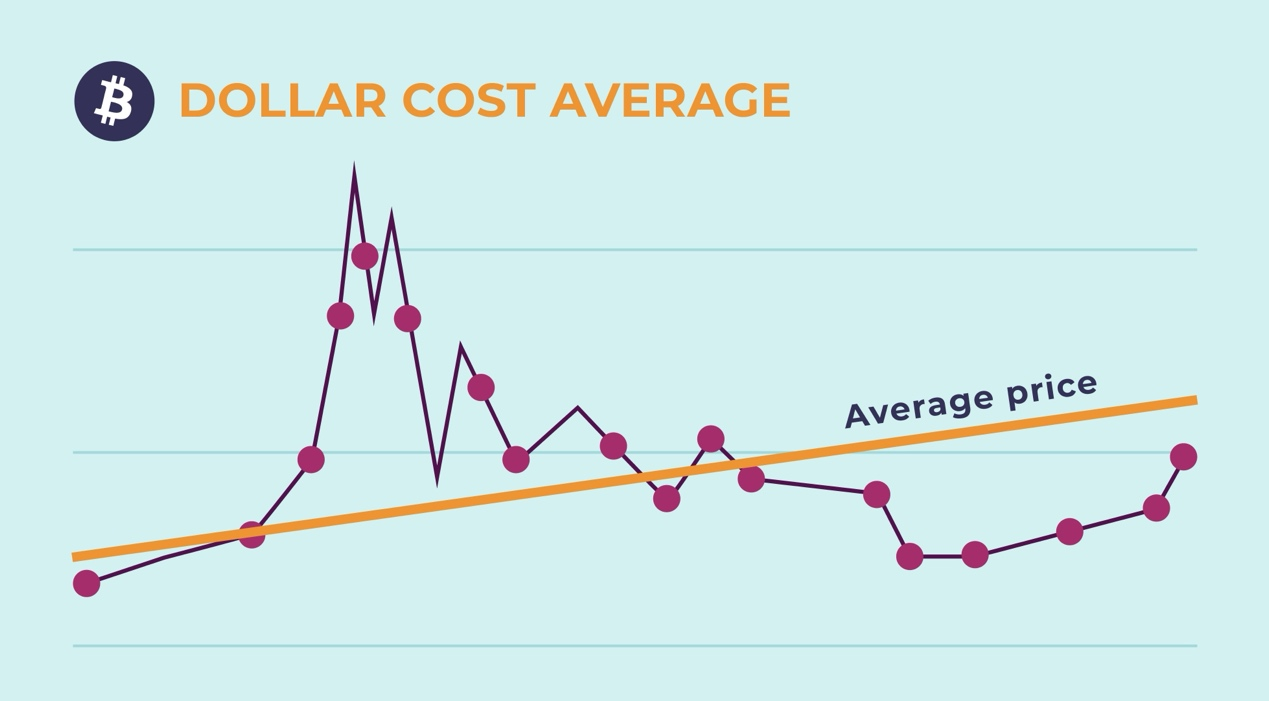

In terms of what you should actually prioritize during a downturn, it’s important to note that investing is not an absolute necessity. If your risk tolerance is low and you don’t have a savings buffer, focus on allocating money to the emergency savings fund and ensure that you’re earning enough interest to beat back losses to inflation (see Chapter 3). The same principle applies to debt management; pay off high-interest debt before you buy stocks (see Chapter 4). Moreover, because the market may be so volatile during a downturn, you may want to implement a strategy of dollar-cost averaging (DCA). Essentially, this is where you buy more of an asset at fixed intervals over a period of time. You’re buying it at different prices, which brings the average cost of assets purchased closer to that of when you sell it. This can technically minimize gains, but also can drastically reduce losses – which is why it’s so common during downturns. Like we talked about before, it’s impossible to time the market.

Source: Coinglass

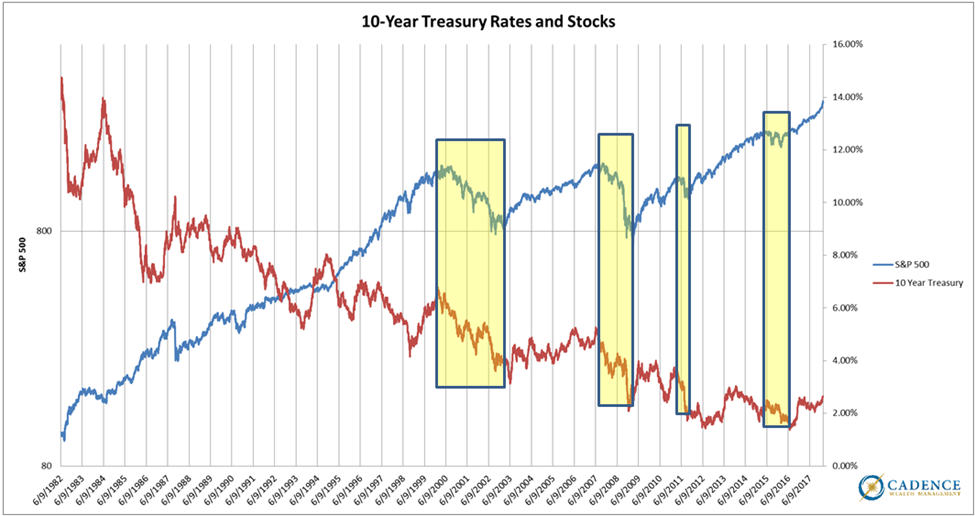

If you’re thinking about future downturns as you begin your investing journey, defensive stocks are great options to consider. These include utilities, consumer staples, and healthcare stocks. Why? Because an economic downturn doesn’t drastically reduce the demand for essentials, which means that these stocks can outperform the market during recessions. Remember, having a diverse portfolio is key – it shouldn’t be composed of entirely defensive stocks, but having a good portion can provide stability. Also, diversity in the industries you’re investing in can hedge against industry-specific downturns. For example, if your entire portfolio was composed of airline stocks prior to the COVID Pandemic, your losses would be much greater than someone who’s portfolio had a bit of everything, from technology stocks, consumer goods stocks, healthcare stocks, bonds, and real estate. It’s also important to note that some asset performances are negatively related. Stocks and bonds, for instance, move in opposite directions because, when stock prices decline, investors prefer safer assets like bonds, which causes their prices to rise.

Source: Cadence Wealth Management

Index funds and exchange-traded funds (ETFs) are another great option. They allow you to invest in a large basket of assets at lower prices, keeping your portfolio diverse, which hedges it against downturns. If you’re seeking guaranteed growth over a long-term, these are your best bet. During recessions, high-paying dividend stocks are another valuable option. They minimize your losses because, even if the stock price falls in sync with the market, the dividend payment offsets it. Also, dividend stocks basically have a price floor – they’re unlikely to drop beyond certain price values because the dividend yield (the annual dividend payment per stock divided by the stock’s price) gets higher as the price of the stock decreases. That is, as the price of the stock gets lower, investors are more attracted to it because the percentage returns they get from dividends become higher. But, like with all assets, these options are not magical solutions to losses from downturns, and you should always be cautious and educated before making an investment. For example, companies can always decide to stop paying dividends if they’re performing poorly during a downturn and have immediate expenses to cover, so pay attention to factors like the dividend payout ratio (which should be low) and the company’s projected budget needs (which should also be low).

Source: Dividend Power

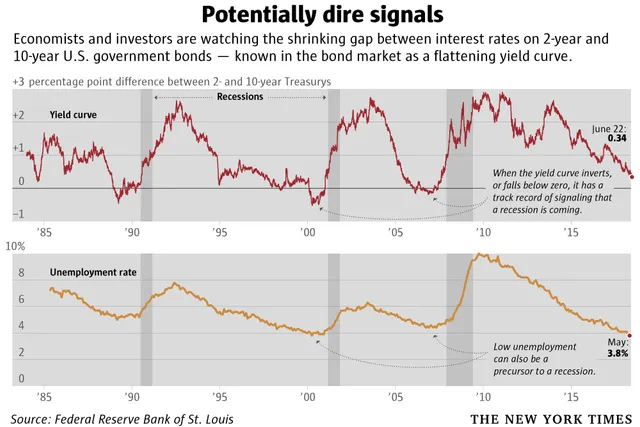

The stock market isn’t the only place to invest in. Especially during a recession, US Treasury bonds are solid options. For starters, they’re much less volatile than stocks. They have fixed interest payments and set maturity dates, and you’re virtually guaranteed a payment. The reason investors often buy these during, not just before, downturns is because their prices actually go up as interest rates and inflation falls. Here’s why: if interest rates are lower than the fixed rates of a bond, then investors would rather put their money into the bond. The lower interest rates get, the more valuable the bond becomes because its rate becomes relatively higher and higher. Likewise, when inflation is low, the fixed bond payments become worth more in real terms, making them more attractive and increasing bond prices.

Source: Federal Reserve Bank of St. Louis, New York Times, Seattle Times

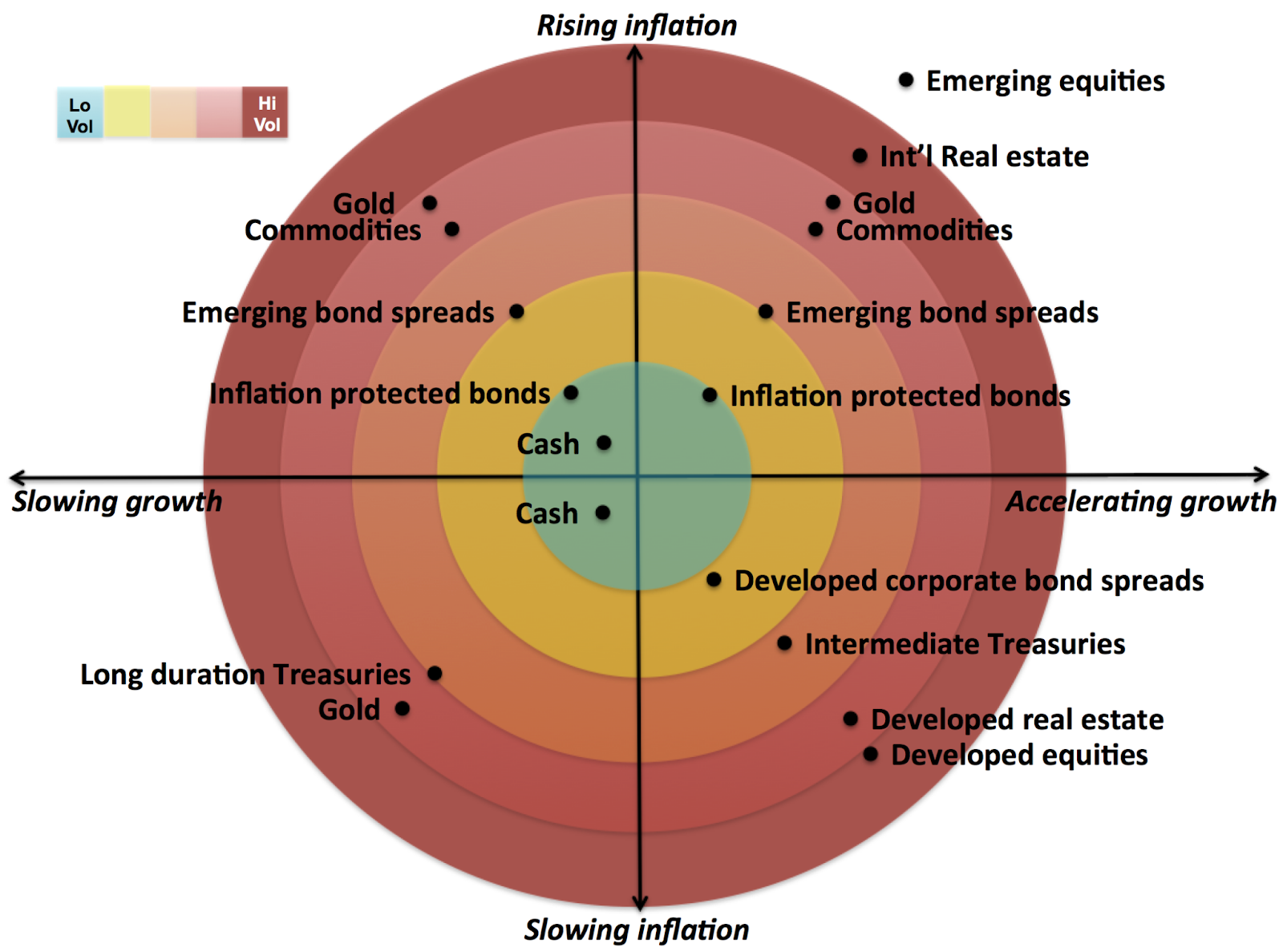

Investments that hedge against inflation include gold and real estate investment trusts (REITs). With gold, it’s basically a store of wealth since its price in dollars is variable. If the dollar’s value decreases, the price of gold increases. The value of REITs, which are like stocks but for the real estate market (you get part ownership in a company that owns investment properties), generally go up during inflationary periods. That’s because, when prices go up, so to do rents, meaning that the value of a REIT share goes up. Inflation-protected savings bonds, issued by the US Treasury and specifically designed to hedge inflation, are another low-risk asset for recessions. They have an initial guaranteed rate for the first six months after purchase, but then their rate is variable and moves with the inflation rate. Nonetheless, it’s important to note that overinvesting in such low-risk assets comes with huge opportunity cost when the market performs well, underscoring the importance of balance.

Source: ReSolve Asset Management

Investments you should definitely avoid during downturns are those that are extremely speculative and volatile, like penny stocks. Buying on margin, which basically means that you’re using debt to buy a stock in order to magnify your gains or losses, is another strategy to avoid during these times. Strategically, don’t get suckered into investments out of the fear of missing out (FOMO). This leads to impulsive investments that lack reasoning and have negative implications. Illiquid assets, too, may trap your money when you need it most – during a recession.

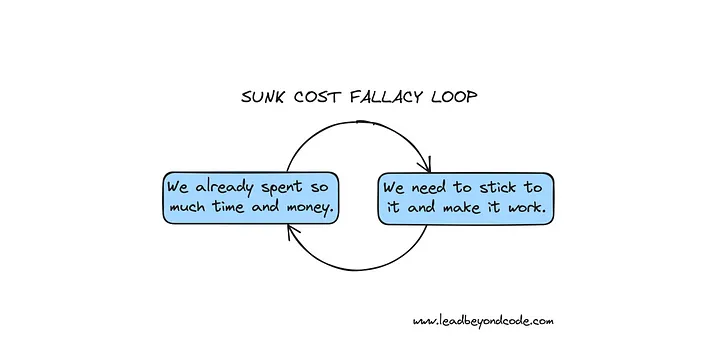

And it’s not just about the investments themselves, but also the psychological investing frameworks applied. Many people often panic when a downturn comes around, implementing a strategy of loss aversion whereby decisions are entirely emotional. Recency bias is another big one; never assume that recent trends will continue indefinitely without analyzing the bigger picture. Also, be aware that sunk cost should not factor into financial decision making. Sunk cost is basically the cost you took on when you bought an asset. No matter what you do, you’ve already taken on that cost. Oftentimes, investors will hold onto a losing asset because they feel the need to recoup their sunk cost, which only results in greater losses. The sunk cost fallacy, marked by a sheer lack of adaptability, is one of the biggest downfalls of investors during recessions.

Source: Medium

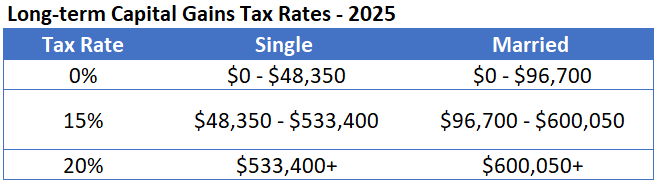

One notable yet difficult-to-implement strategy is called tax-loss harvesting. Essentially, this is when investors recognize that one of their assets is underperforming, so they intentionally sell it at a loss such that it can offset that capital gains tax that they make on another investment. This strategy is highly specific and depends on certain tax classifications; every sale at a loss you make is not tax-loss harvesting. Another strategy that’s important for every investor to do is rebalancing. Essentially, this just means that you’re periodically checking in on your investments and buying more or less of an asset as necessary to maintain a portfolio that aligns with your risk tolerance and long-term goals, especially because recessions can entirely reshape the allocation of a given portfolio.

Source: Darrow Wealth Management

But where the majority of investors get involved is in the recovery period following a recession. And that’s something to always be on the lookout for – read the news to understand consumer confidence and employment numbers, which can indicate a rebound. It is best to reinvest gradually, not suddenly pouring your money in at once, to prepare for any potential double-dips. Historically, some sectors recover particularly fast, like technology, whereas others, like construction, are especially slow, which may be important to consider in some cases. Still, it really depends on the underlying cause of the recession and how its sector-specific impacts unfold.