How Taxes Affect the Economy and Society

Taxes are not only a way to collect government revenue; they are tools which shape economies, influential social institutions, and drive behaviors in individuals. Whether it be increasing economic growth, reducing income inequality, or helping make positive choices, taxes have diverse impacts in today's world.

Economic Impacts

Taxes influence the economic landscape by impacting growth, redistribution of wealth, and business operations. At its core, taxes are used to allocate resources to contribute to societal and economic needs. Progressive tax systems are crucial in reducing income inequality because they redistribute wealth. By redistributing wealth, systems ensure that resources flow towards important public services such as infrastructure, education, and healthcare, which all stimulate future economic growth. However, if taxes are too high, they can prohibit investment savings, leading to the slowing of economic growth.

In addition, taxation has a profound impact on the decisions businesses make. For example, corporate taxes can influence whether companies expand, innovate, or relocate. For businesses, high tax rates can discourage investment, causing businesses to move to regions with more favorable tax systems. On the other hand, tax incentives such as credits for research and development will encourage growth and innovation. For example, governments that offer subsidies for renewable energy projects have seen a rise in investments in green technologies, forming new markets and jobs while being environmentally efficient.

Taxes also impact employment patterns and changes. Payroll taxes are crucial for economic stability, but often increase employment costs for businesses. Higher payroll taxes can sometimes influence employers to limit hiring or move costs around by reducing the wages of employees. However, payroll taxes are necessary because they help ensure that workers have access to safety nets during retirement or economic hardship, helping maintain overall societal stability.

Social Impacts

Beyond economic impacts, taxes play an impactful role in societal changes and the promotion of equity. Progressive taxation systems are primarily used to reduce income disparities, making sure wealth is redistributed to support public welfare. For example, Scandinavian countries use high tax rates on high income workers to fund free healthcare, education, and childcare. This type of system aims for social cohesion because it provides all citizens with access to essential services regardless of their income levels.

Revenue from taxes is crucial for improving public welfare. Programs such as public education, affordable housing initiatives, and healthcare are often funded by taxes, and allow for the improvement of communities. For example, tax funded Medicaid programs in the US help provide healthcare to millions of low income people, and infrastructure projects supported by taxes connect communities and stimulate local economies. In developing nations, tax policies have been crucial in addressing systematic inequalities, allowing access to clean water, electricity, and healthcare in underserved areas.

Taxation also empowers governments to address systemic inequalities through progressive policies. For example, tax funded social programs severely reduced poverty rates and improved educational outcomes in many regions. Through redistributing wealth and prioritizing public investments, governments can create more equitable societies and provide opportunities for all citizens to succeed.

Behavior Effects

Apart from economic and societal impacts, taxes also influence individual and corporate behaviors by creating financial incentives and demotivators. Governments often design tax policies to encourage positive actions that benefit the economy and society. For instance, Medicaid in the US and infrastructure projects such as the highways and public transportation both rely on tax funding. In developing nations, targeted tax policies are important to address systemic inequalities, giving essential services like clean water and healthcare to the more unfortunate population.

Taxes also influence individual and corporate behavior by creating financial incentives and disincentives. Governments often use tax policies to encourage positive economic activities. For example, tax deductions for contributions to retirement accounts incentivize saving, while tax credits for energy efficient home upgrades support sustainable and environmentally healthy practices. Businesses also respond to tax incentives by investing in underserved regions or adopting eco-friendly operations.

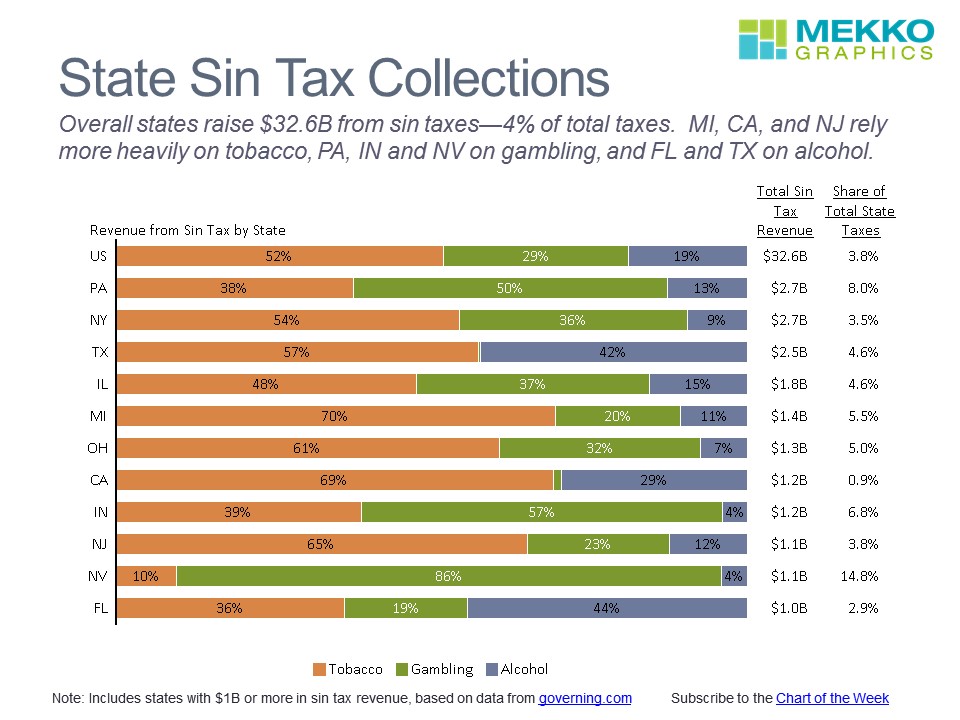

On the flip side, taxes can also serve as disincentives to discourage harmful behaviors. Sin taxes, which are levied on harmful products such as alcohol, tobacco, and sugary drinks, are designed to reduce consumption while increasing tax revenue. For example, higher taxes on cigarettes have been linked to reduced smoking rates, especially among youth. Similarly, taxes on sugary drinks have also caused a change of mindset in consumers, who are now shifting towards healthier alternatives. In cities such as Berkley, California, and other popular areas, the placing of a soda tax has led to a significant decline in sugary drinks consumption, showing the effectiveness of disincentive taxes.

Source: Mekko Graphics

Taxation has become a cornerstone of economic and social development. Taxes influence growth, redistribute wealth, and guide behaviors, shaping foundations of modern societies. Their impact is much more than funding government activities; they extend to a significant amount of aspects in daily life. Effective tax policies balance the need for revenue while demonstrating qualities of fairness, efficiency, and social welfare. Taxation remains one of the most powerful instruments for the government in the world, promoting equity, encouraging positive behavior, and supporting essential services.