Introduction to Taxation

Taxes are a pillar in modern society, supporting funding for public services and communities. Although they are considered financial obligations, taxes help a community collectively ensure stability and progress. Imagine a neighborhood pooling money to build a shared bridge; on a larger scale, taxes do the same - they help a society thrive. Without taxes, the foundations of communities would weaken. Through taxation, income inequality decreases through redistribution resources to support those in need, making taxes crucial for a balanced society.

Taxation dates far back into history, showing the evolution of economies. During the ancient Mesopotamian times, taxes were paid through livestock and grain because of its agricultural economy. During the Roman empire, taxes were used for funding armies and construction projects. In medieval Europe, monarchs used taxes to finance wars. During the Industrial Revolution, taxes shifted to income based due to the complexities of the social classes and economies. Throughout the ages, taxes have adapted to the changes in the society and economy.

Tax systems have multiple principles to prove their fairness and efficiency. Equity makes sure people contributed based on their income and ability to pay. The higher the income, the higher the taxes.

Source: Illustrating Equality vs. Equity

Certainty provides clear guidelines to avoid confusion and foster trust in the system. Convenience minimizes the burden on taxpayers, encouraging compliance and making the process straightforward. Efficiency ensures that taxes support government functions without stifling economic growth or creating loopholes that could be exploited. Together, these principles balance the need for revenue with the broader goal of societal welfare.

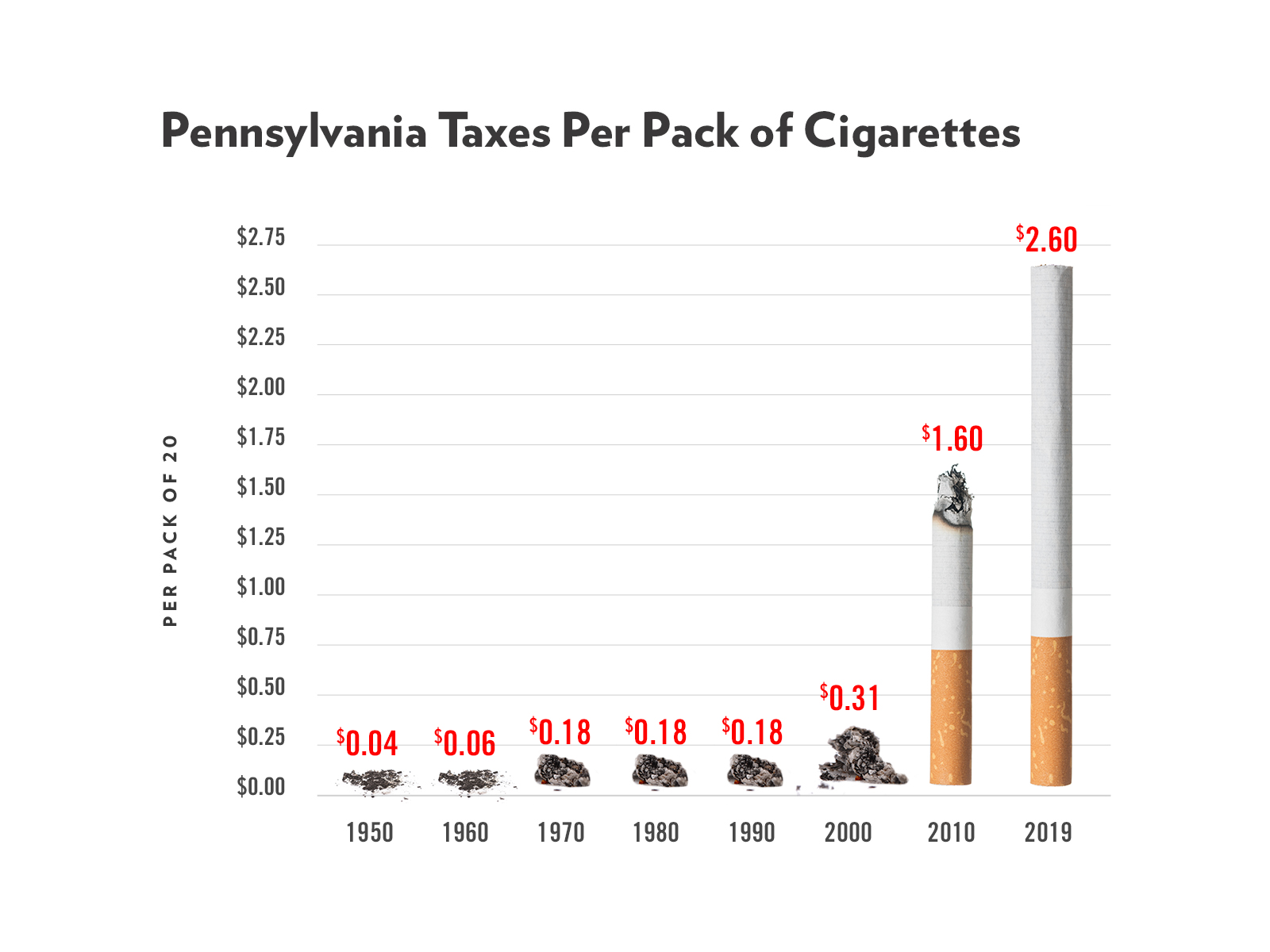

Beyond services, taxes help form a sense of shared responsibility. Taxes are a social contract in which everyone contributes for the greater good. Tax revenues help with the construction of roads, funding of schools, and supporting healthcare systems. Additionally, they can influence behavior through incentives for using renewable energy or penalties for harmful activities such as smoking. By understanding how taxation works, people can participate in shaping policies that ensure fairness and effectiveness in meeting society’s needs.

Source: Cigarette Taxes

In conclusion, taxation is more than just a financial obligation—it’s a vital part of how societies function and thrive. It provides resources for public services, promotes fairness, and influences behaviors to align with societal goals. From ancient civilizations to today’s complex economies, taxes have shaped the world. Recognizing its importance allows us to engage thoughtfully in discussions about how taxes can continue to build better futures for all.