Foundations of AI & Machine Learning for Finance

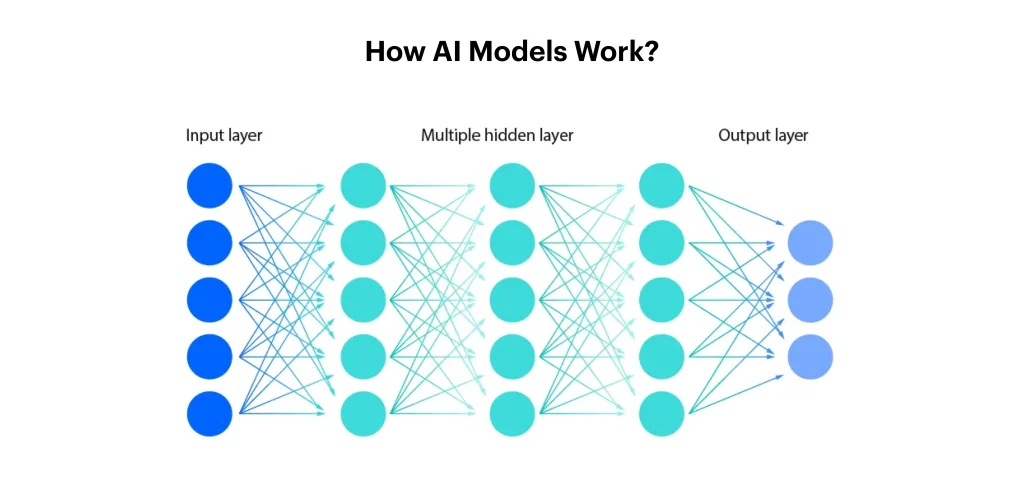

AI in finance is not a crystal ball trick, where everything seemingly lines up at the request of one quick prompt. Instead, it is a set of teachable algorithms that learn from data and use that data to make probabilistic forecasts. Think of a spam filter for email, but instead of answering to “spam vs. not spam,” it answers “fraudulent wire transfer vs. legitimate” or “stock that will outperform vs. underperform.” The math completed here is the same, where data enters, patterns are found, and probabilities are then spit out. But in this case, the stakes are set in dollars, reputations, and regulators - all constantly monitoring the program. Key building blocks include supervised learning, unsupervised learning, and reinforcement learning (think trial and error with rewards). The crucial financial twist is that every model must be judged against risk-adjusted returns, regulatory constraints, and business objectives - not purely accuracy. In other words, at the base of AI’s use in finance is its predictive capabilities and its ability to take data, process it, and spit out a prediction. And whilst humans are more than capable of completing a task of similar difficulty, AI has the power to enhance speed and error ranges in this process. This efficiency and accuracy are what make AI an indispensable tool in modern finance.

Source: Openxcell