Dividend Yield vs Dividend Growth

2 / 4

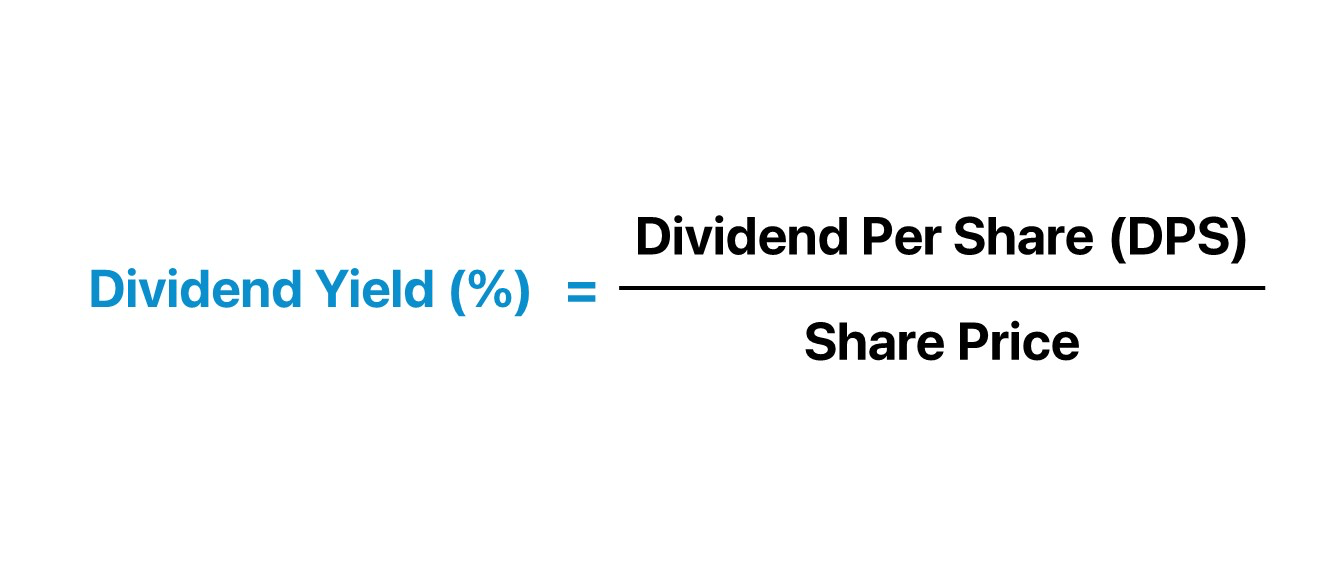

Source: Wall Street Prep

Note that dividend yield is calculated using annual dividends per share, regardless of if the dividend is paid quarterly, monthly, or on any other schedule.

For example, if a dividend pays 5.00$ per quarter and the stock price is $100.00, the dividend yield is 20%. This is because the dividend pays $20.00 per year.

It is also important to note that a high dividend yield can be a sign of falling stock prices. Since dividend yield uses the current share price in the denominator, a sharp drop in price automatically raises the yield, even if the money paid hasn’t changed. This can reflect potential market concerns about a company’s financial future