Dividend Yield vs Dividend Growth

3 / 4

Dividend growth represents an increase in dividend payments. Investing in a company with a high dividend growth means the dividends you receive per year will likely grow.

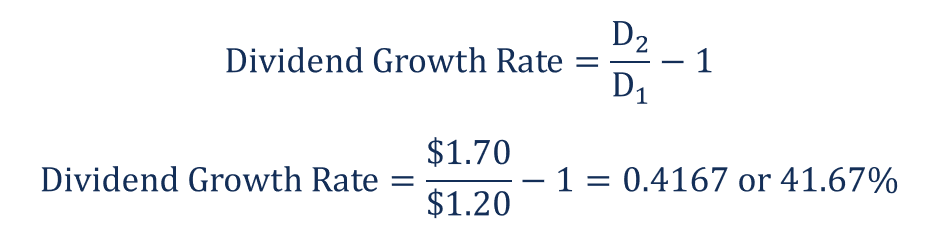

Dividend growth can be calculated with the following formula:

Source: Corporate Finance Institute

For example, if a company paid $10.00 in dividends this year and it paid $8.00 last year, its dividend growth rate is 25%. This means if the company continues on this trajectory, it would expect to keep growing its dividends by about 25% each year; in just three years, they’d nearly double from $10.00 to about $19.53.